Tax Navigation by PaperWerks

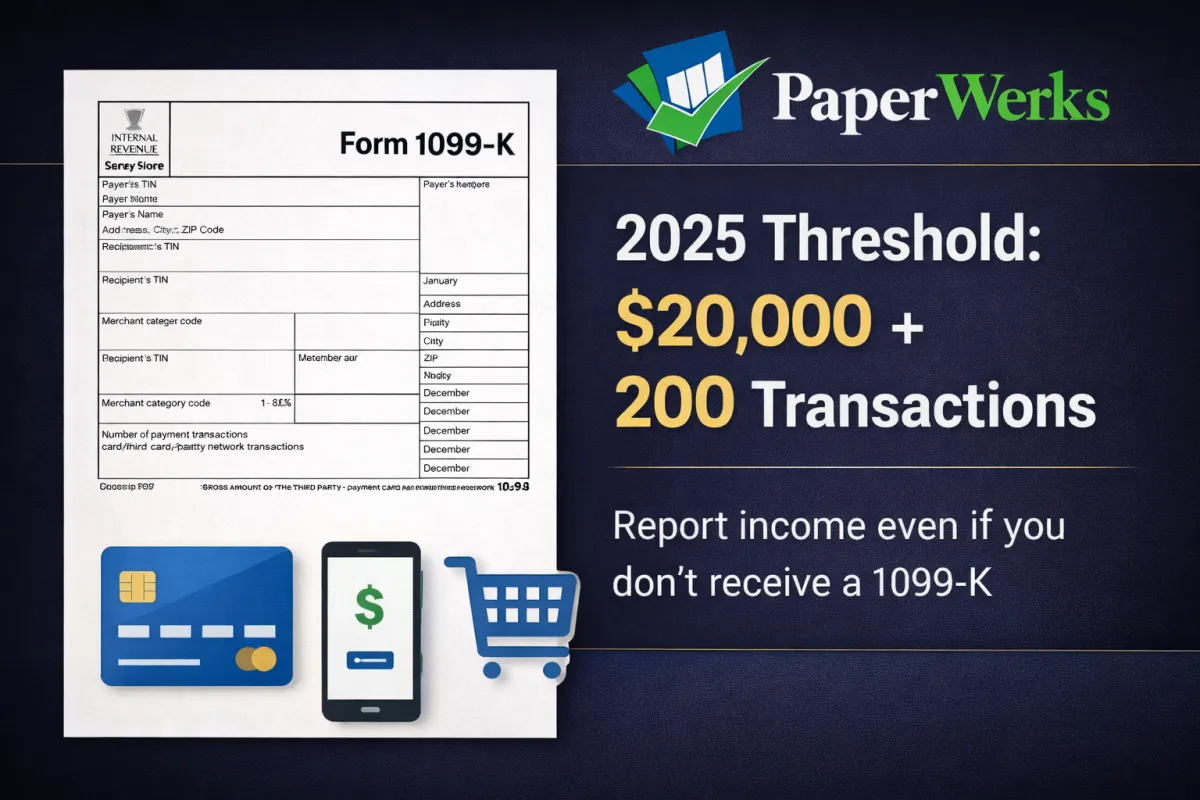

Form 1099-K Reporting Rules (Tax Year 2025): What to Know

Published on: 02/01/2026

A practical guide to Form 1099-K reporting rules for tax year 2025—what triggers a 1099-K, what counts as reportable payments, what doesn’t (friends/family), and what to do if your form is incorrect.

IRS Forms1099-KGig Economy

Understanding Form 1099-K: What You Need to Know for 2025

Published on: 01/01/2026

Wondering about IRS Form 1099-K for 2025? Learn who receives it, what gets reported, and how to handle errors. Whether you’re a small business, freelancer, or occasional seller, this guide breaks down everything you need to know to stay compliant and avoid surprises. Need help? PaperWerks offers expert, personalized tax support!

IRS Forms